UK SME Confidence: Key Sectors Show Promise Despite Overall Dip

The latest Business Sentiment Index from Close Brothers Asset Finance reveals a fascinating split in UK business confidence, with some sectors showing remarkable resilience whilst others face increasing pressures. As an independent, FCA-regulated finance specialist with over two decades of experience, we're sharing these insights to help businesses understand their sector's position and available funding options.

Key Findings at a Glance:

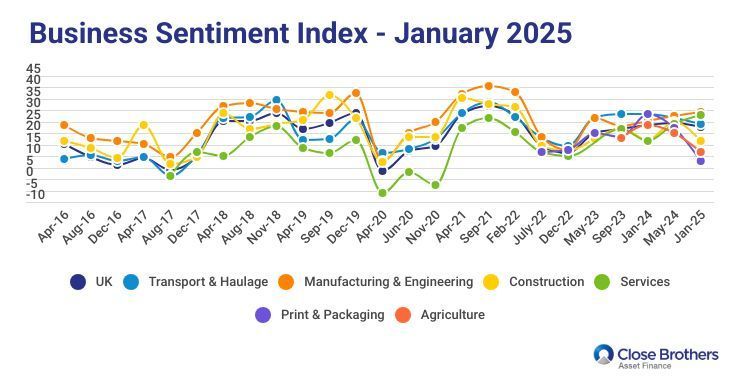

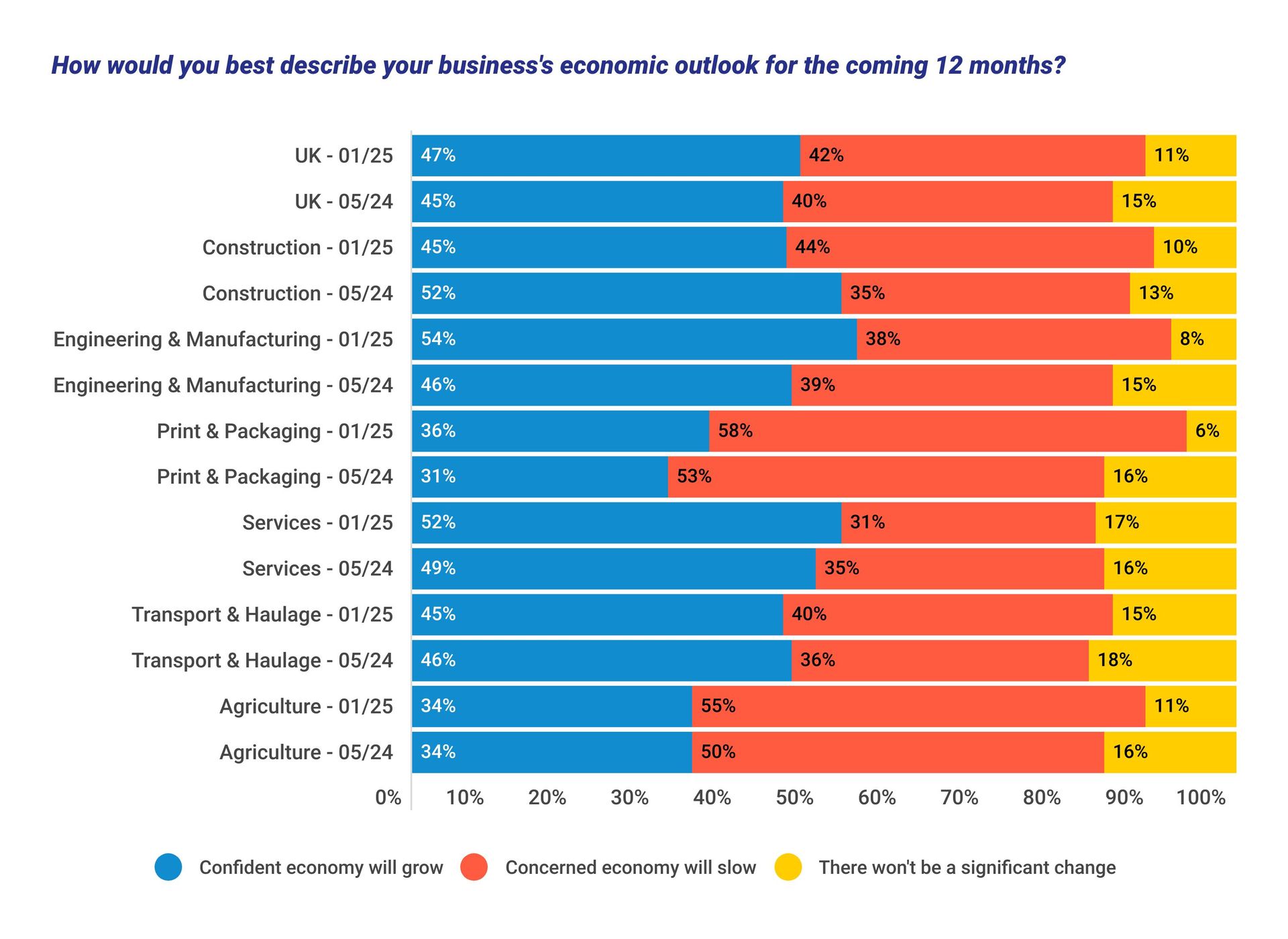

- Manufacturing & Engineering sector confidence has reached its highest level since February 2022

- Services sector achieving unprecedented positive sentiment scores

- 72% of firms planning strategic investments in 2025

- 45% of businesses report missed opportunities due to funding constraints

Investment Appetite Remains Strong

Close Brothers' research reveals 72% of firms are actively seeking investment opportunities for 2025 - a 6% increase from May 2024. This shows that despite challenges, businesses are looking to grow and adapt.

The Funding Gap Challenge

A critical finding shows 45% of businesses have missed opportunities due to lack of available funding - the highest level in 18 months. As Matt Roper, CEO of Close Brothers' Commercial business, notes: "Typically, sentiment in the sectors rise and fall together, but this time there's a real and noticeable disparity."

What This Means for Your Business:

Whether you're in manufacturing looking to invest in new machinery, or in agriculture needing to navigate seasonal challenges, access to appropriate funding is crucial. As an appointed representative of Rural Finance Limited with a 90% acceptance rate, we work with over 30 leading lenders to help businesses secure the right funding helping you to grow effectively.

Looking Ahead

While current confidence levels haven't yet reached the peaks seen in November 2021 (when 75% of respondents were positive), the varied sector performance suggests opportunities for businesses with the right funding strategy.

Need Expert Guidance?

Here at Gavin Dixon Finance Solutions we are well-positioned to help you navigate these market conditions. Whether you're looking to invest in new equipment, expand your fleet, or require working capital solutions, our team can help identify the most suitable funding options for your business.

Complete the

form below to begin a conversation with our team.

Let's begin a conversation.

We're here to help you drive your business forward by delivering the competitive finance solutions you need - when you need them.

If you would like to talk to the GDFS Sales Team, please call us today on 01308 480248. Alternatively, you can simply complete the enquiry form.

fields marked with an * are required.

We look forward to working with you.

So we can understand your requirements, we will need to gather some information from you.

Any personal information submitted to GDFS via this route will only be used for the purposes of servicing your enquiry. If you would like further details of how we process your data, please read our Privacy Policy and Terms & Conditions notice.

Gavin Dixon Finance Solutions Limited is an Appointed Representative of Rural Finance Limited. Rural Finance is authorised and regulated by the Financial Conduct Authority, FRN 630701. Rural Finance Limited is an authorised credit broker and not a lender. GDFS is acting as a credit broker and not a lender. We can introduce you to several carefully selected credit providers who may be able to offer finance for your asset funding needs. We will receive a commission from the lender for any successful introduction. Finance is available subject to status. Terms and conditions apply. Applicants must be 18 or over. Guarantees and/or indemnities may be required. For more information, please visit the FCA website. FCA website

Contact Us

Thank you for contacting GDFS

We will get back to you as soon as possible.

Please try again later.

We empower British businesses to reach their potential by providing flexible finance options and funding.

Contact

Visit Our Office:

Edward Tower Building – Office 5

St Michael’s Estate

Bridport

Dorset

DT6 3RB

Registered Business Address:

GDFS Ltd, Bridport DT6 9FH

Office Number:

01308 480248

Company

Legal

Gavin Dixon Finance Solutions Limited is an Appointed Representative of Rural Finance Limited. Rural Finance is authorised and regulated by the Financial Conduct Authority, FRN 630701. Rural Finance Limited is an authorised credit broker and not a lender. GDFS is acting as a credit broker and not a lender. We can introduce you to several carefully selected credit providers who may be able to offer finance for your asset funding needs. We will receive a commission from the lender for any successful introduction. Finance is available subject to status. Terms and conditions apply. Applicants must be 18 or over. Guarantees and/or indemnities may be required. For more information, please visit the FCA website. FCA website

© 2013-2025 Gavin Dixon Finance Solutions Ltd, All Rights Reserved. - Registered in England & Wales. - Company No. 08526694.

In partnership with Defined Marketing UK